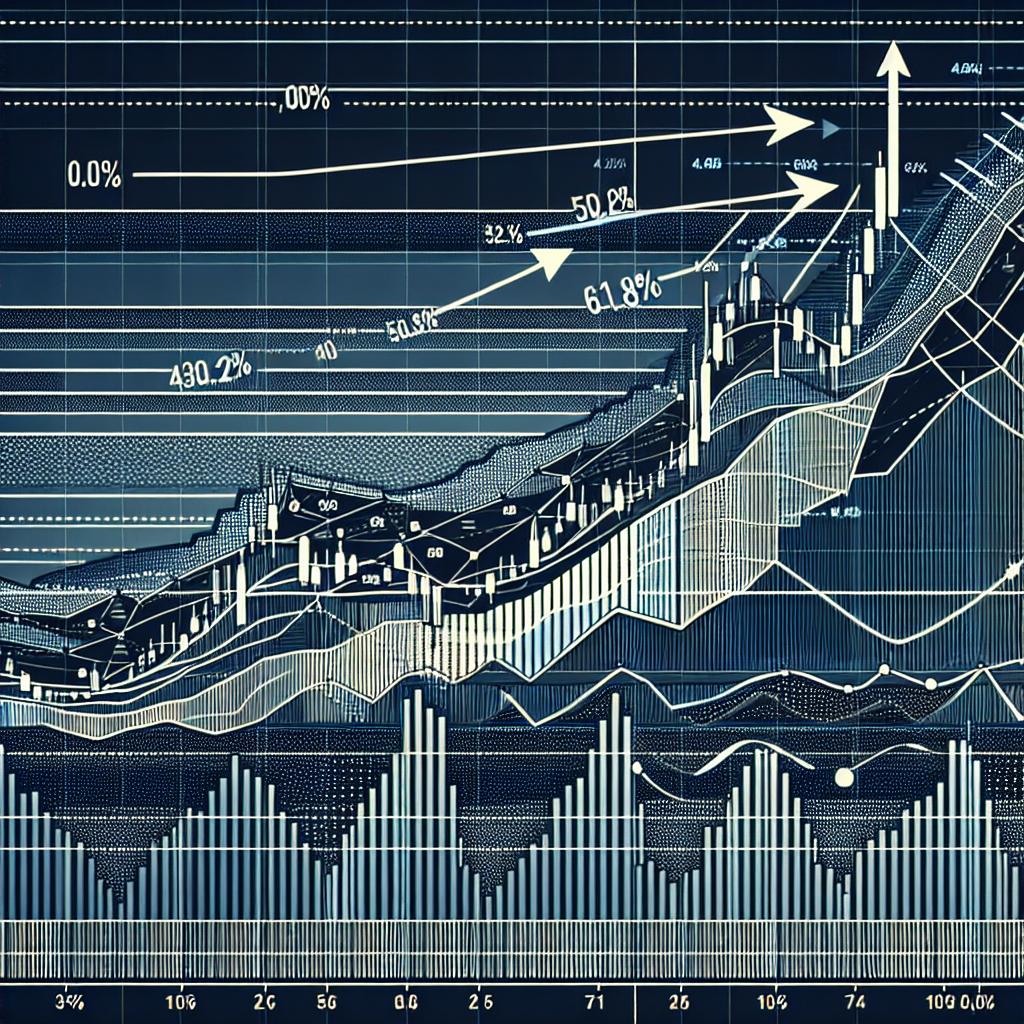

Exploring the Diverse Applications of Fibonacci Retracements in Trading

Fibonacci Retracement Applications

In the world of trading, Fibonacci retracement is a popular tool used by traders to identify potential support and resistance levels. These levels are determined by the Fibonacci sequence, a mathematical series of numbers where each number is the sum of the two preceding ones. In this article, we will explore the various applications of Fibonacci retracement.

What are Fibonacci Retracements?

Fibonacci retracements are horizontal lines that indicate potential reversal levels on a price chart. They are based on Fibonacci numbers, a sequence that starts with 0 and 1, and each subsequent number is the sum of the previous two. When applied to trading, these numbers are converted into percentages – 23.6%, 38.2%, 50%, 61.8%, and 100%.

These percentages are used to create potential support and resistance levels. Traders use these levels to identify potential reversal points in the market where they can enter or exit trades.

Applications of Fibonacci Retracements

Identifying Support and Resistance Levels

One of the main applications of Fibonacci retracements is to identify potential support and resistance levels. These are price levels at which the price of an asset is likely to stop and reverse. Support is a price level where buying pressure is strong enough to prevent the price from falling further, while resistance is a level where selling pressure is strong enough to prevent the price from rising further.

Setting Stop Loss and Take Profit Levels

Fibonacci retracements can also be used to set stop loss and take profit levels. A stop loss order is an order to sell an asset when it reaches a certain price, to limit losses. A take profit order is an order to sell an asset when it reaches a certain price, to lock in profits. Traders often set their stop loss and take profit levels at or near Fibonacci retracement levels.

Identifying Trend Reversals

Another application of Fibonacci retracements is to identify trend reversals. If the price of an asset is trending up or down and then reverses direction at a Fibonacci retracement level, this could be a sign that the trend is reversing.

Confirming Other Technical Analysis Signals

Fibonacci retracements can also be used to confirm other technical analysis signals. For example, if a trader identifies a potential buy signal using another technical analysis tool, they might use Fibonacci retracements to confirm this signal. If the price is at or near a Fibonacci retracement level, this could be a confirmation that the buy signal is valid.

Conclusion

Fibonacci retracements are a versatile tool that can be used in a variety of ways in trading. Whether you’re identifying support and resistance levels, setting stop loss and take profit levels, identifying trend reversals, or confirming other technical analysis signals, Fibonacci retracements can be a valuable addition to your trading toolkit.