Technical analysis

Mastering Market Predictions with Sentiment Indicators

Introduction to Sentiment Indicators Understanding market dynamics is complex, requiring insights not just into financial metrics and economic indicators but also into the psychology of investors and traders. One of the key tools used to gauge this psychological aspect is sentiment indicators. These indicators provide a glimpse into the mood of the market participants, helping […]

Mastering Trend Analysis with Moving Averages

Introduction to Moving Averages Moving averages are among the most popular tools used by traders and analysts to understand market trends and make predictions. Essentially, a moving average smooths out price data to create a single flowing line, making it easier to identify the direction of the trend. There are several types of moving averages, […]

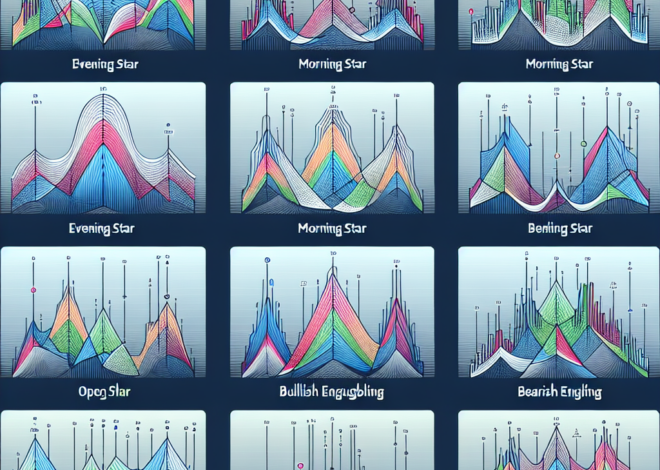

Mastering Advanced Candlestick Patterns for Trading

# Advanced Candlestick Patterns: A Guide for Traders Candlestick patterns are a crucial tool in the arsenal of many traders, offering insights into market sentiment and potential price movements. While basic candlestick patterns are widely known and utilized, advanced patterns can provide deeper insights and higher accuracy in predicting market trends. This article dives into […]

Exploring Trend Analysis with Moving Averages

# Trend Analysis Using Moving Averages In the world of finance, economics, and market analysis, understanding trends is crucial for forecasting and making informed decisions. One of the most widely used techniques to identify and analyze trends is through moving averages. This article delves into the concept of trend analysis using moving averages, outlining its […]

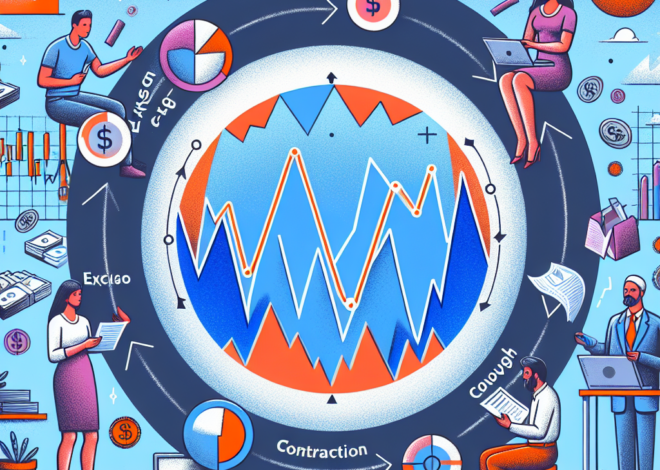

Mastering the Market: A Comprehensive Guide to Understanding Market Cycles

Understanding Market Cycles In the world of investing and finance, understanding market cycles is crucial. Market cycles refer to the periods of growth and decline in the economy or a particular industry, which can affect investment returns. By understanding these cycles, investors can make more informed decisions about when to buy or sell assets. In […]

Mastering Trade Signals with the MACD Indicator

Using MACD for Trade Signals The Moving Average Convergence Divergence (MACD) is a powerful trading tool that can provide potential buy and sell signals. It is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. In this article, we will delve into how to use MACD for trade […]

Understanding and Trading with Harmonic Patterns in Forex

Trading with Harmonic Patterns Introduction to Harmonic Patterns Harmonic patterns in trading are specific price structures or sequences that have distinct and repetitive characteristics. They were discovered by H.M. Gartley in 1932 and later developed by Scott Carney in his book, “Harmonic Trading”. These patterns are used to predict future price movements and can be […]

Guide to Identifying Key Support and Resistance Zones in Trading

Identifying Key Support and Resistance Zones Trading in the financial markets involves a deep understanding of various technical analysis tools and techniques. One such crucial concept is the identification of key support and resistance zones. These zones are significant because they offer potential trading opportunities. In this article, we will delve into the process of […]

Guide to Identifying and Verifying Reliable Support Levels

Finding Reliable Support Levels Support levels are a critical concept in technical analysis used to predict the price direction of an asset, such as a stock or cryptocurrency. They represent a price level or area below the current market price where buying is strong enough to overcome selling. This results in a price bounce upward. […]

Decoding Market Cycles: A Comprehensive Guide for Investors

Understanding Market Cycles Market cycles are inevitable and crucial aspects of the economic landscape. They’re characterized by periods of growth (expansion) and decline (contraction), affecting everything from stock prices to employment rates. Understanding these cycles can help investors make informed decisions about when to buy or sell assets. In this article, we will delve into […]