Exploring RSI Oscillator Strategies for Effective Trading

RSI Oscillator Strategies

The Relative Strength Index (RSI) is a popular momentum oscillator used by traders to identify potential buy and sell signals. The RSI oscillates between zero and 100 and is typically used to identify overbought or oversold conditions in a market. In this article, we will discuss several RSI oscillator strategies that can be used to improve your trading decisions.

Understanding the RSI Oscillator

The RSI oscillator is a momentum indicator invented by J. Welles Wilder in 1978. It measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally, the RSI is considered overbought when above 70 and oversold when below 30.

Calculation of RSI

The RSI is calculated using the following formula:

RSI = 100 – (100 / (1 + RS))

Where RS represents the average gain of up periods during the specified time frame divided by the average loss of down periods.

RSI Oscillator Strategies

There are several ways to use the RSI in trading. Here are some of the most common strategies.

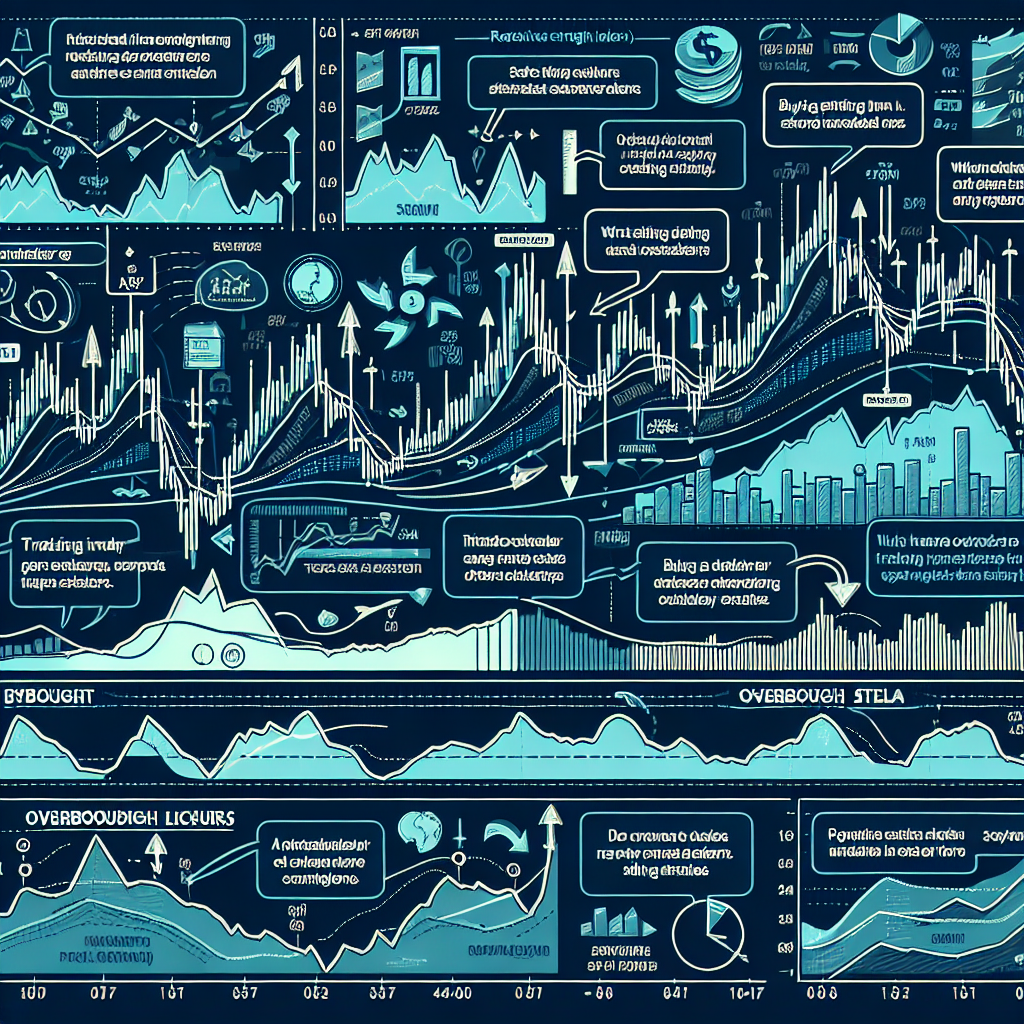

1. Overbought and Oversold Strategy

This is the most basic strategy using the RSI. When the RSI goes above 70, the asset is considered overbought, indicating a potential sell opportunity. Conversely, when the RSI goes below 30, the asset is considered oversold, indicating a potential buy opportunity.

2. Divergence Strategy

Divergence occurs when the price of an asset is moving in the opposite direction of the RSI. This can be a signal that the current trend is weakening and could potentially reverse. For example, if the price is making higher highs while the RSI is making lower highs, this is known as bearish divergence and could indicate that the upwards trend is about to reverse.

3. RSI Trendline Break Strategy

This strategy involves drawing a trendline on the RSI chart and then looking for instances where the RSI breaks through this trendline. This can be a signal that the current trend is changing and can provide a potential trading opportunity.

4. RSI Swing Rejection Strategy

The RSI swing rejection strategy is another advanced RSI strategy. It involves looking for instances where the RSI forms a lower high during an uptrend or a higher low during a downtrend. This can be a signal that the trend is about to reverse.

Conclusion

The RSI oscillator is a versatile tool that can be used in a variety of trading strategies. Whether you’re using it to identify overbought and oversold conditions, spot divergence, or look for trendline breaks or swing rejections, the RSI can provide valuable insights into market conditions. However, like all trading indicators, it’s important to use the RSI in conjunction with other tools and analysis techniques to increase the likelihood of successful trades.