Mastering the Bollinger Band Squeeze Technique in Trading

The Bollinger Band Squeeze Technique

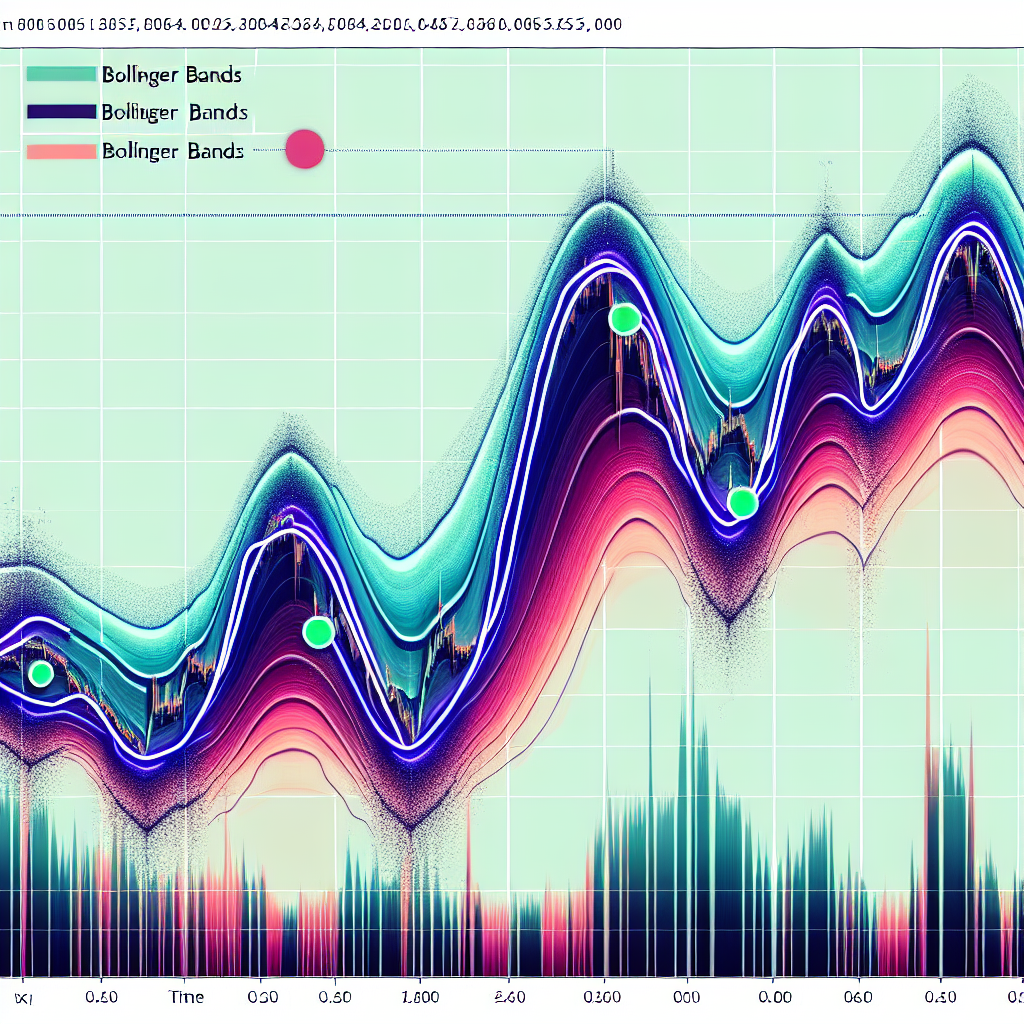

The Bollinger Band squeeze technique is a popular trading strategy used by traders to identify potential breakout points in the market. This strategy is based on the concept of Bollinger Bands, a technical analysis tool developed by John Bollinger in the 1980s. The Bollinger Bands consist of a simple moving average (middle band) and two standard deviation lines (upper and lower bands) plotted on a price chart.

Understanding the Bollinger Band Squeeze

The Bollinger Band squeeze occurs when the volatility in the market decreases, causing the upper and lower bands to move closer together. This “squeeze” is often seen as a period of consolidation before a significant price move, either upward or downward. Traders use this squeeze as an opportunity to prepare for the upcoming breakout.

Identifying a Bollinger Band Squeeze

The first step in using the Bollinger Band squeeze technique is to identify when a squeeze is occurring. This is typically done by looking for a period of decreasing volatility, which is indicated by the upper and lower bands moving closer together. When the bands are close together, it indicates that the price is relatively stable, but this low volatility is often followed by a period of high volatility.

Interpreting a Bollinger Band Squeeze

Once a squeeze has been identified, the next step is to interpret what it means. A squeeze does not indicate which direction the price will move, only that a significant price move is likely to occur. Traders will often look for other indicators, such as volume or price patterns, to predict the direction of the breakout.

Trading with the Bollinger Band Squeeze

Trading with the Bollinger Band squeeze involves waiting for the squeeze to occur, then placing trades in anticipation of the breakout. This can be done in a number of ways, depending on the trader’s strategy and risk tolerance.

Entering a Trade

One common strategy is to enter a trade when the price breaks above the upper band or below the lower band after a squeeze. This is seen as an indication that the price is starting to move with increased volatility, and the breakout is beginning.

Setting Stop Losses

Another important aspect of trading with the Bollinger Band squeeze is setting stop losses. Because the squeeze does not indicate the direction of the breakout, it’s possible for the price to move in the opposite direction of the trade. Setting a stop loss can limit the potential loss in this scenario.

Conclusion

The Bollinger Band squeeze technique is a powerful tool for identifying potential breakout points in the market. By understanding how to identify and interpret a squeeze, traders can position themselves to take advantage of significant price moves. However, like all trading strategies, it’s important to use the Bollinger Band squeeze in conjunction with other indicators and risk management techniques to increase the chances of successful trading.