Understanding and Applying Elliott Wave Forecasting Models

Introduction to Elliott Wave Forecasting Models

The Elliott Wave Theory, proposed by Ralph Nelson Elliott in the late 1930s, is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. This theory has been widely adopted by traders and investors for its ability to accurately predict market trends based on investor behavior.

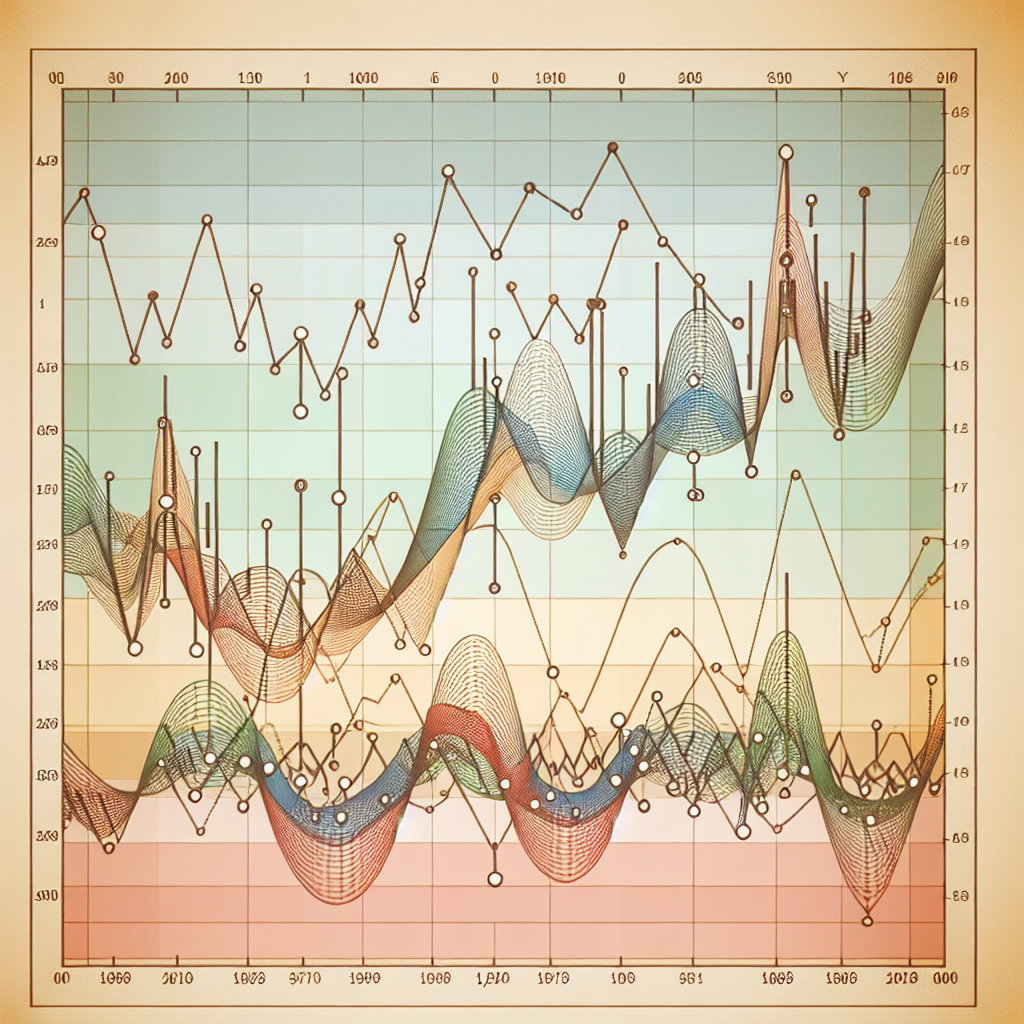

Understanding the Elliott Wave Principle

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns, or waves, in the price movements of markets at every degree of trend or time scale.

Elliott’s theory somewhat resembles the Dow theory in that both recognize that stock prices move in waves. However, Elliott was able to break down and analyze these movements in much greater detail.

Basic Structure of Elliott Waves

According to Elliott, there are two types of waves: impulse waves and corrective waves. An impulse wave consists of five sub-waves that move in the same direction as the trend of the next larger size, while a corrective wave consists of three sub-waves.

Impulse Waves

Impulse waves are typically characterized by strong movement in the direction of the trend, followed by a period of consolidation or pullback. They are divided into a 5-wave sequence.

Corrective Waves

Corrective waves, on the other hand, are slightly more complex. They move in the opposite direction to the primary trend and are divided into a 3-wave sequence.

Applying the Elliott Wave Forecasting Model

The Elliott Wave model offers a comprehensive method for assessing market stages and forecasting future trends. Traders can use this model to identify market cycles and anticipate future market movement based on the most likely wave count.

Identifying the Wave Count

The first step in applying the Elliott Wave model is to identify the wave count. This involves identifying the start of a wave, usually a significant high or low, and counting the waves as they progress.

Forecasting Future Market Movement

Once the wave count is identified, traders can then use this information to predict future market movement. For example, if the market is currently in the third wave of an impulse wave, a trader may anticipate a short-term pullback before the market continues its upward trend.

Limitations of the Elliott Wave Forecasting Model

While the Elliott Wave forecasting model can be a powerful tool for predicting market trends, it is not without its limitations. The model relies heavily on accurate identification of the wave count, which can be subjective and prone to error. Additionally, the model does not account for external factors such as economic data or news events that can impact market trends.

In conclusion, the Elliott Wave forecasting model offers a unique approach to predicting market trends by analyzing investor psychology and market cycles. Despite its limitations, it remains a popular tool among traders and investors for its ability to provide a comprehensive view of market trends and potential future movements.