Understanding and Using MACD for Effective Trade Signals

Introduction to MACD

The Moving Average Convergence Divergence (MACD) is a popular trading indicator used in technical analysis of stock prices. It’s designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

Understanding MACD

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of two lines and a histogram: The MACD line, the signal line, and the histogram which represents the difference between the two lines.

MACD Line

The MACD line is the faster line on the indicator. It’s calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA.

Signal Line

The signal line is the slower line on the indicator. It’s a 9-day EMA of the MACD line.

Histogram

The histogram simply plots the difference between the MACD line and the signal line.

Using MACD for Trade Signals

MACD generates bullish and bearish signals from three main sources: crossovers, overbought/oversold conditions, and divergences.

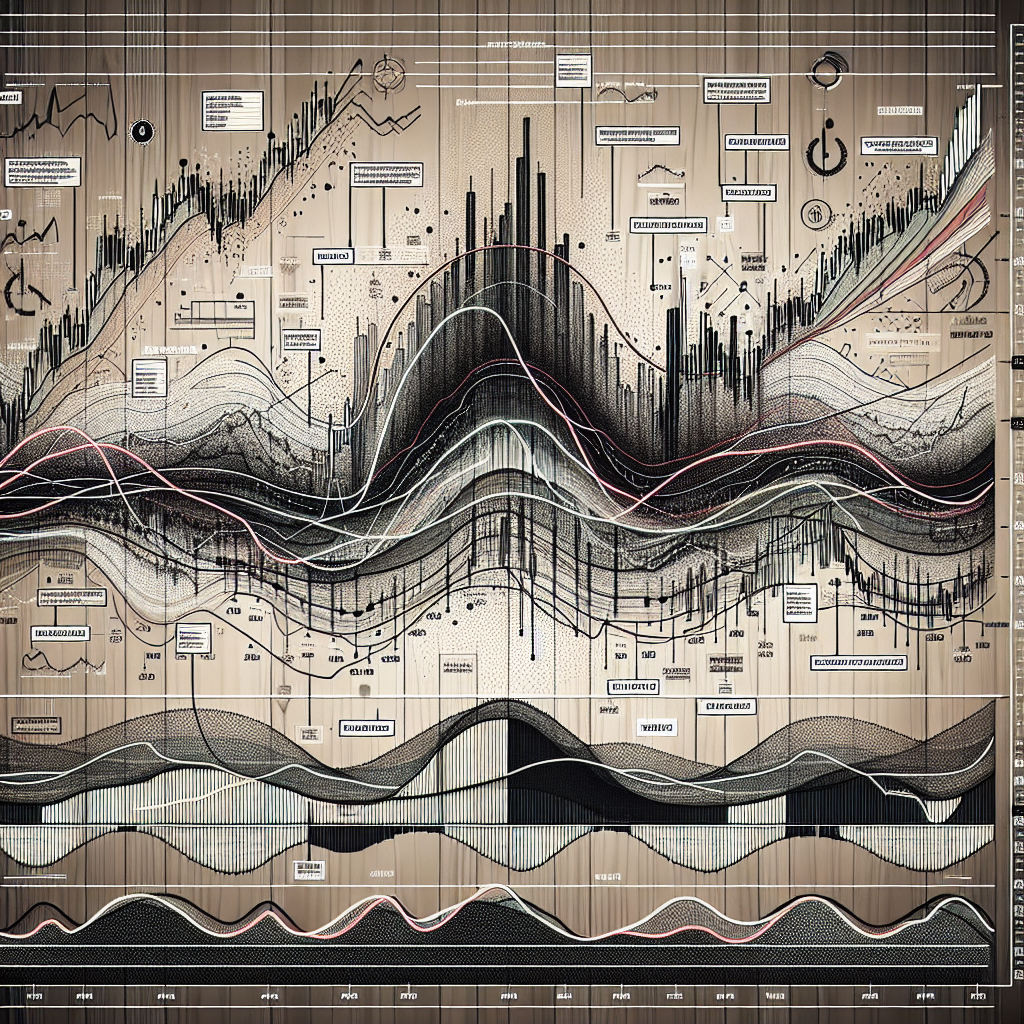

Crossovers

Crossovers are the most common MACD signals. A bullish crossover occurs when the MACD line crosses above the signal line. Conversely, a bearish crossover occurs when the MACD line crosses below the signal line.

Overbought/Oversold Conditions

When the MACD line and the signal line are far apart, the security is considered overbought or oversold. A bearish signal is generated when the security is overbought, while a bullish signal is generated when the security is oversold.

Divergences

A divergence occurs when the security’s price and the MACD move in opposite directions. When the price is making new highs but the MACD isn’t, a bearish divergence occurs, and this can be a sign that a bearish reversal is coming. Conversely, when the price is making new lows but the MACD isn’t, a bullish divergence occurs, and this can be a sign that a bullish reversal is coming.

Conclusion

The MACD is a versatile tool that can provide a trader with valuable information about the direction and strength of a trend, as well as potential buy and sell signals. Like all indicators, it should be used in conjunction with other forms of analysis to confirm signals and prevent false alarms. With practice and experience, traders can use the MACD to make more informed trading decisions.